Terra Clean Energy Corp. Announces Agreement to Earn 100% Interest in 75 Past Producing Uranium Claims on The San Rafael Swell, Utah, United States

Vancouver B.C., September 16, 2025 – TERRA CLEAN ENERGY CORP. (“Terra” or the “Company”) (CSE: TCEC, OTCQB: TCEFF, FSE: 9O0, is pleased to announce terms to acquire up to a 100% interest in 75 uranium claims in Emery County, Utah, United States.

Transaction Highlights

- Nine Past Producing Uranium mines covered on the Claims having produced several hundred thousand tons of ore grading up to 1% U308

- Visible Uranium, Vanadium, Copper and Cobalt at Surface with numerous uranium readings up to 21,000 CPS equating to grades .22% U308

- Close Proximity to major roads with good year around access, power and a uranium mill located 75 miles drive

- Strong Government support for nuclear power and uranium mining projects and a stated objective to reduce reliance on foreign nuclear fuel

- Staged earn-in allows the company to optimize exploration programs

- Provides Terra shareholders exposure to two North American assets both with near surface Uranium opportunities in low-risk jurisdictions

Greg Cameron stated “One of my stated goals with Terra was to add another low-risk uranium project to the Company and this transaction does just that. Having toured the properties with our VP Exploration, it is clear from the moment you arrive you are in a uranium district with many old workings, adits, shafts and old infrastructure. I am excited to see work begin this fall and believe there to be a clear path to add significant value for our shareholders.”

Rationale Behind the Acquisition

Green Vein Mesa and Wheal Anne Claims offer exposure to uranium projects in the USA with excellent upside in a significant historical uranium district. Terra has made a strategic decision to acquire the Green Vein Mesa and Wheal Anne Claims due to the belief there is more minable uranium present. It is important to note that the encompassing claims have a production history. Both sets of claims are in ideal locations, situated near main roads, secondary roads and have access to power and water sources. In the past, mining operations focused on ore found at or near surface. The process of oxidation led to the formation of various secondary uranium minerals. The Trump Administration has recently enacted historic policies designed to accelerate nuclear power and uranium mining activity in the country”

“This initial project in San Rafael Swell offers significant upside as it is clear that these old mines were abandoned in the 1970’s due to a uranium market collapse not because they ran out of uranium to mine,” stated Greg Cameron, CEO of Terra. “We believe strongly that we can expand on the previous work through modern exploration technologies like 3D modelling” added Trevor Perkins VP Exploration.

Project Overview

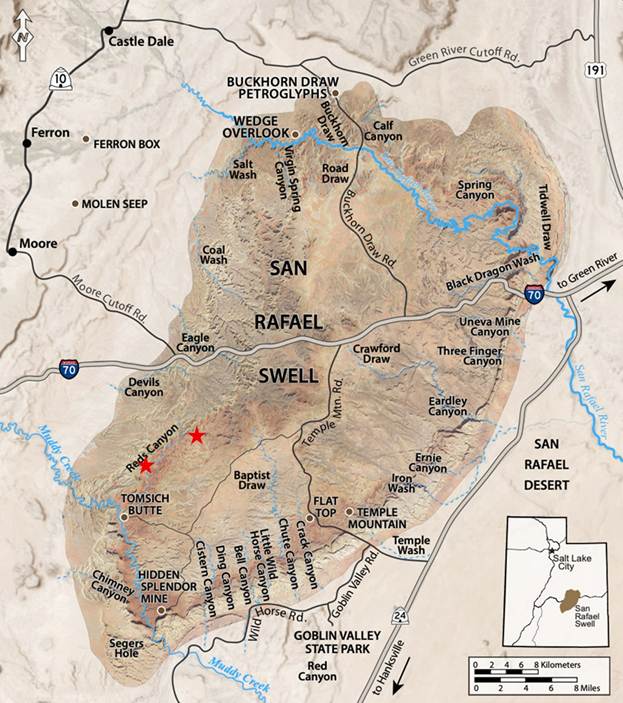

The San Rafael Swell is a large, uplifted, doubly-plunging anticline in east-central Utah and the Swell forms part of, but contrasts with the surrounding flat-lying rocks, of the Colorado Plateau, a significant uranium mining district in the Western United States. Historical uranium production was undertaken in the region between the late 1940’s into the 1970’s. No significant work has been completed in the region in the past 50 years.

The rocks in the San Rafael Swell are predominately sedimentary (Pennsylvanian through Cretaceous), including Triassic and Jurassic formations that are known to host uranium. The project area is underlain by Triassic aged sedimentary rocks of the Moenkopi and Chinle formations. The Chinle outcrops in a continuous belt around the San Rafael Swell and on isolated buttes through the center of the swell. It is widely believed that volcanic ash is the source of uranium for many deposits in the swell. All existing mines and prospects in the Chinle are in the lower, bentonitic part of the Chinle in channel-fill sandstone and surrounding siltstones of the lower Chinle Formation. . In the Green Vein Mesa area these occur as scour channel fill at the contact with the underlying Moenkopi Formation.

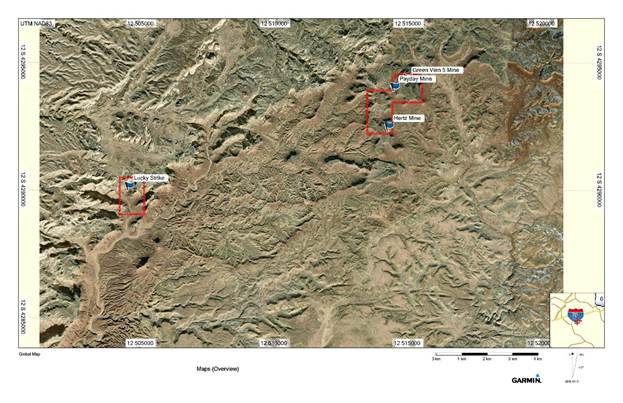

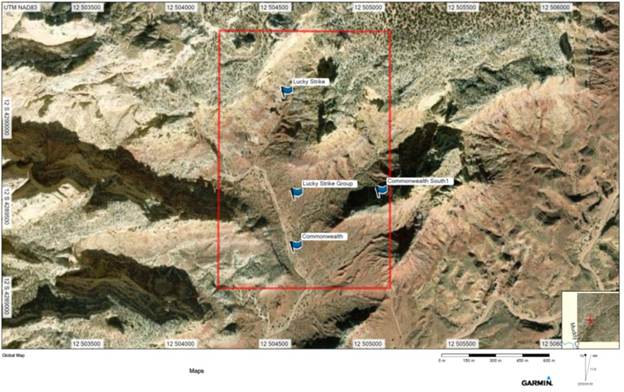

The project is separated into two claim groups 10 km apart. The Wheal Anne Claim Group is the southwest of the two and encompasses approximately 130 hectares covering the former producing Lucky Strike Mine and related uranium occurrences. The Lucky Strike Mine was discovered in 1949 and produced more than 10,000 tons of ore grading 0.22% U3O8 and 0.09% V2O5. [1]

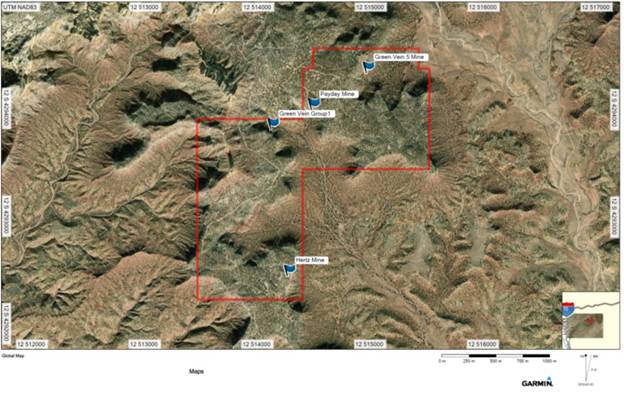

The Green Vein Mesa Claim Group to the northeast encompasses approximately 300 hectares and covers the former producing Payday Mine, Hertz Mine, and Green Vein group of mines. Production numbers for these mines were not located, however the Hertz Mine reportedly had local samples up to 1% U3O8.[2]

Figure 1: Map of the San Rafael Swell from the Utah Geological Survey. The Wheal Anne and Green Vein Mesa Claim Group locations are shown by the red stars.

Figure 2: Overview of the Wheal Anne (West)and Green Vein Mesa (East) Claim Groups

Figure 3: The Wheal Anne Claim Group, covering the historical Lucky Strike and Commonwealth Uranium Mines and showings.

Figure 4: The Green Vein Mesa Claim Group, covering the historical Payday, Hertz, Green Vein Group, and Green Vein #5 Uranium Mines.

Figure 5: Uraninite vein near the Payday Mine workings.

Figure 6: Green Vein Group Mine workings and ore chute.

Transaction Overview

To earn its respective interests in each of the Wheal Anne Claims and the Green Vein Mesa, the Company would be required to make the following cash payments, common share issuances and incur exploration expenditures on the respective claims as follows:

Wheal Anne Claims

| Cash Payment | Share Issuance | Exploration Expenditures |

To earn a 20% interest | USD$20,000 on execution of definitive agreement | 500,000 common shares within five business days of the execution of definitive agreement | Incur USD$100,000 in expenditures on or before the 1st year anniversary of the execution of definitive agreement |

To earn a 40% interest | Additional USD$33,333 on or before the 1st year anniversary of the execution of definitive agreement | Additional 500,000 common shares on or before the 1st year anniversary of the execution of definitive agreement | Incur additional USD$33,333 in expenditures on or before the 2nd year anniversary of the execution of definitive agreement |

To earn a 60% interest | Additional USD$46,666 on or before the 2nd year anniversary of the execution of definitive agreement | Additional 500,000 common shares on or before the 2nd year anniversary of the execution of definitive agreement | Incur additional USD$33,333 in expenditures on or before the 3rd year anniversary of the execution of definitive agreement |

To earn an 80% interest | Additional USD$60,000 on or before the 3rd year anniversary of the execution of definitive agreement | Additional 500,000 common shares on or before the 3rd year anniversary of the execution of definitive agreement | Incur additional USD$33,334 in expenditures on or before the 4th year anniversary of the execution of definitive agreement |

To earn a 100% interest | Additional USD$73,333 on or before the 4th year anniversary of the execution of definitive agreement | Additional 500,000 common shares on or before the 4th year anniversary of the execution of definitive agreement | Incur additional USD$33,333 in expenditures on or before the 5th year anniversary of the execution of definitive agreement |

** Subject to the retention by the Vendors of a two percent (2%) net royalty on the Wheal Anne Claims (the “Wheal Anne Royalty”), with Terra Clean having the option to purchase fifty percent (50%) of the Wheal Anne Royalty at any time by making a total cash payment to the Vendors in the amount of USD$666,666.

Green Vein Mesa Claims

| Cash Payment | Share Issuance | Exploration Expenditures |

To earn a 20% interest | USD$10,000 on execution of definitive agreement | 250,000 common shares within five business days of the execution of definitive agreement | Incur USD$50,000 in expenditures on or before the 1st year anniversary of the execution of definitive agreement |

To earn a 40% interest | Additional USD$16,667 on or before the 1st year anniversary of the execution of definitive agreement | Additional 250,000 common shares on or before the 1st year anniversary of the execution of definitive agreement | Incur additional USD$13,334 in expenditures on or before the 2nd year anniversary of the execution of definitive agreement |

To earn a 60% interest | Additional USD$23,334 on or before the 2nd year anniversary of the execution of definitive agreement | Additional 250,000 common shares on or before the 2nd year anniversary of the execution of definitive agreement | Incur additional USD$13,334 in expenditures on or before the 3rd year anniversary of the execution of definitive agreement |

To earn an 80% interest | Additional USD$30,000 on or before the 3rd year anniversary of the execution of definitive agreement | Additional 250,000 common shares on or before the 3rd year anniversary of the execution of definitive agreement | Incur additional USD$13,334 in expenditures on or before the 4th year anniversary of the execution of definitive agreement |

To earn a 100% interest | Additional USD$36,667 on or before the 4th year anniversary of the execution of definitive agreement | Additional 250,000 common shares on or before the 4th year anniversary of the execution of definitive agreement | Incur additional USD$13,334 in expenditures on or before the 5th year anniversary of the execution of definitive agreement |

** Subject to the retention by the Vendors of a two percent (2%) net royalty on the Green Vein Mesa Claims (the “Green Vein Royalty”), with Terra Clean having the option to purchase fifty percent (50%) of the Green Vein Royalty at any time by making a total cash payment to the Vendors in the amount of USD$333,334.

The agreements to acquire an interest in each of the Wheal Anne Claims and the Green Vein Mesa Claims remains subject to the receipt of all regulatory approvals, including the approval of the Canadian Securities Exchange.

All securities issued in connection with these agreements would be subject to a four-month plus one day hold period from the date of issuance in accordance with applicable securities laws.

About Terra Clean Energy Corp.

Terra Clean Energy is a Canadian-based uranium exploration and development company. The Company is currently developing the South Falcon East uranium project within the Fraser Lakes B Uranium Deposit, located in the Athabasca Basin region, Saskatchewan, Canada as well as developing past producing Uranium mines in the San Rafael Swell Emery County, Utah, United States

ON BEHALF OF THE BOARD OF TERRA CLEAN ENERGY CORP.

“Greg Cameron”

Greg Cameron, CEO

Qualified Person

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101, reviewed and approved on behalf of the company by C. Trevor Perkins, P.Geo., the Company’s Vice President, Exploration, and a Qualified Person as defined by National Instrument 43-101.

*The historical results, production, and interpretation described here in have not been verified and are extracted from US Geological Survey reports. The Company has not completed sufficient work to confirm and validate any of the historical data contained in this news release. The historical work does not meet NI 43-101 standards. The Company considers the historical work a reliable indication of the potential of the San Rafael Swell and the information may be of assistance to readers. Information collected during a site visit in September 2025 was collected using an RS-225 “Super-Spec” Spectrometer manufactured, inspected and calibrated in 2025.

Forward-Looking Information

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information, including statements regarding the potential development of mineral resources and mineral reserves which may or may not occur. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and general economic and political conditions. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary approvals, including governmental and regulatory approvals will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, other than as required by applicable laws. For more information on the risks, uncertainties and assumptions that could cause our actual results to differ from current expectations, please refer to the Company’s public filings available under the Company’s profile at www.sedarplus.ca.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

For further information please contact:

Greg Cameron, CEO

info@tcec.energy

Terra Clean Energy Corp

Suite 303, 750 West Pender Street

Vancouver, BC V6C 2T7

[1] Source: U.S. Geological Survey Bulletin 1239, 1968, Geology, Altered Rocks and Ore Deposits of The San Rafael Swell, Emery County, Utah, By C.C. Hawley, R. C. Robeck and H.B. Dyer.

[2] Source: U.S. Geological Survey Bulletin 1239, 1968, Geology, Altered Rocks and Ore Deposits of The San Rafael Swell, Emery County, Utah, By C.C. Hawley, R. C. Robeck and H.B. Dyer.